सुकन्या समृधि योजना क्या है ?

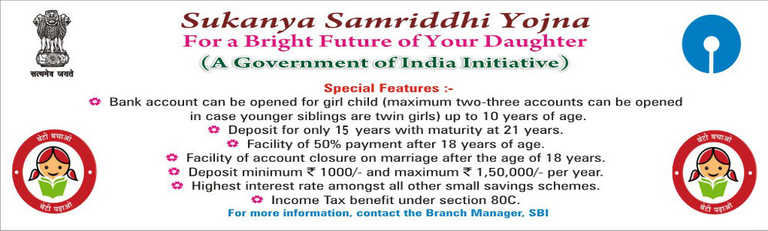

This is investment scheme introduced for girl child. In this scheme minimum investment of 250 INR (two hundreds & fifty rupees) is needed annually. Maximum investment allowed in this scheme is INR 1,50000. Sukanya Smridhi Yojna saving account can be opened in nearby bank or post office.

सुकन्या समृधि योजना किसी और योजना से बेहतर कैसे है ?

ये किसी और योजना के मुक़ाबले (जैसे की बैंक में फ़िक्स डिपॉज़िट ) सबसे ज़्यादा ब्याज डर देता है । Sukanya Smridhi Yojna is providing highest returns among other saving schemes such as FD & RD. This is good saving option instead of going to fixed deposits.

Initially, the interest rate was set at 9.1%. Later this was revised to 9.2% in late March 2015 for FY2015-16.Interest Rates have been revised for FY 2016-17 to 8.6%.

8.1% was the interest rate for 1 Jan 2018 to 30 Sep 2018. For the period 1 Oct 2018 to 31 Dec 2018 interest rates are set to 8.5%.

सुकन्या समृधि योजना से टैक्स कैसे बचा सकते हैं ? For Tax saving u/s 80C:

Sukanya Smridhi Yojna (SSY) provides maximum benefit for tax savings exemption for taxes under section 80C. The limit for 80C section is only 1.5 lakh and this is also the amount which can be invested in Sukanya Smridhi Yojna.

Facts:-

Country: India, Launched on : 22 January 2015 , Launched & introduced by: Prime Minister Narendra Modi

The scheme was launched by H'ble Prime Minister Narendra modi ji on 22 January 2015 as a part of the Beti Bachao, Beti Padhao campaign.

- Log in to post comments